The Gardner Report | Fourth Quarter 2017

ECONOMIC OVERVIEW

The Washington State economy added 104,600 new jobs over the past 12 months. This impressive growth rate of 3.1% is well above the national rate of 1.4%. Interestingly, the slowdown we saw through most of the second half of the year reversed in the fall, and we actually saw more robust employment growth.

Growth continues to be broad-based, with expansion in all major job sectors other than aerospace due to a slowdown at Boeing.

With job creation, the state unemployment rate stands at 4.5%, essentially indicating that the state is close to full employment. Additionally, all counties contained within this report show unemployment rates below where they were a year ago.

I expect continued economic expansion in Washington State in 2018; however, we are likely to see a modest slowdown, which is to be expected at this stage in the business cycle.

HOME SALES ACTIVITY

- There were 22,325 home sales during the final quarter of 2017. This is an increase of 3.7% over the same period in 2016.

- Jefferson County saw sales rise the fastest relative to fourth quarter of 2016, with an impressive increase of 22.8%. Six other counties saw double-digit gains in sales. A lack of listings impacted King and Skagit Counties, where sales fell.

- Housing inventory was down by 16.2% when compared to the fourth quarter of 2016, and down by 17.3% from last quarter. This isn’t terribly surprising since we typically see a slowdown as we enter the winter months. Pending home sales rose by 4.1% over the third quarter of 2017, suggesting that closings in the first quarter of 2018 should be robust.

- The takeaway from this data is that listings remain at very low levels and, unfortunately, I don’t expect to see substantial increases in 2018. The region is likely to remain somewhat starved for inventory for the foreseeable future.

HOME PRICES

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.- Economic vitality in the region is leading to a demand for housing that far exceeds supply. Given the relative lack of newly constructed homes—something that is unlikely to change any time soon—there will continue to be pressure on the resale market. This means home prices will rise at above-average rates in 2018.

- Compared to the same period a year ago, price growth was most pronounced in Lewis County, where home prices were 18.8% higher than a year ago. Eleven additional counties experienced double-digit price growth as well.

- Mortgage rates in the fourth quarter rose very modestly, but remained below the four percent barrier. Although I anticipate rates will rise in 2018, the pace will be modest. My current forecast predicts an average 30-year rate of 4.4% in 2018—still remarkably low when compared to historic averages.

DAYS ON MARKET

- The average number of days it took to sell a home in the fourth quarter dropped by eight days, compared to the same quarter of 2016.

- King County continues to be the tightest market in Western Washington, with homes taking an average of 21 days to sell. Every county in the region saw the length of time it took to sell a home either drop or remain static relative to the same period a year ago.

- Last quarter, it took an average of 50 days to sell a home. This is down from 58 days in the fourth quarter of 2016, but up by 7 days from the third quarter of 2017.

- As mentioned earlier in this report, I expect inventory levels to rise modestly, which should lead to an increase in the average time it takes to sell a house. That said, with homes selling in less than two months on average, the market is nowhere near balanced.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Windermere Foundation Surpasses $35 Million In Giving

The Windermere Foundation had another banner year in 2017, raising even more than it did the prior year thanks to the continued support of Windermere franchise owners, agents, staff, and the community. Over $2.4 million was raised in 2017, which is an increase of eight percent over the previous year. This brings our total to over $35.5 million raised since the start of the Windermere Foundation in 1989.

A portion of the money raised last year is thanks to our agents who each make a donation to the Windermere Foundation from every commission they earn. Additional donations from Windermere agents, the community, and fundraisers made up 66% of the money collected in 2017. These funds enable our offices to support local non-profits that provide much-needed services to low-income and homeless families in their communities.

SUMMARY OF FUNDS, GRANTS & DONATIONS IN 2017

- Organizations served: 472

- Number of individual grants fulfilled: 644

- Average grant amount: $2,964.04

- Average donation to the Windermere Foundation: $116.08

FUNDING BREAKDOWN

- Total amount disbursed in 2017: $2,249,357.14

- Total disbursed through grants: $1,908,843.54

- Scholarships: 5%

- Youth/Child Programs: 33%

- Emergency Assistance: 24%

- Shelter: 11%

- School Assistance: 5%

- Education/Counseling: 12%

- Administrative Expenses: 2%

- Fundraising Expenses: 8%

So how are Windermere Foundation funds used? Windermere offices decide for themselves how to distribute the money in their local community. Our offices have helped support school lunch and afterschool programs, housing assistance for homeless families, food banks, homeless shelters, and non-profits that provide basic necessities, such as shoes, clothing, toiletries, and blankets to families in need.

A very notable day in 2017 for the Windermere Foundation was November 15, when a record-breaking $253,782 was given in a single day. A total of 35 non-profit organizations benefitted from that day’s donations, including Attain Housing in Kirkland, WA, which received $56,000 from the Windermere Real Estate East, Inc. group of offices. Other organizations that received donations were Boys and Girls Club of Contra Costa in Walnut Creek, CA, and the Shady Cove School in Shady Cove, Oregon.

2017 also marked the second year of our #tacklehomelessness campaign with the Seattle Seahawks, in which Windermere committed to donating $100 for every Seahawks home game defensive tackle to YouthCare, a non-profit organization that provides critical services to homeless youth. While the Seahawks didn’t make it to the playoffs this year, they did help us raise $31,800. When added to last year’s $35,000, that’s a total donation of $66,800. We are grateful for the opportunity to provide additional support to homeless youth thanks to the Seahawks, YouthCare, and the #tacklehomelessness campaign.

Thanks to our agents, offices, and everyone who supports the Windermere Foundation, we are able to continue to make a difference in the lives of many families in our local communities. If you’d like to help support programs in your community, please click the Donate button.

To learn more about the Windermere Foundation, visit http://www.windermere.com/foundation.

What Can We Expect From The 2018 Housing Market?

What Can We Expect From The 2018 Housing Market?

By Matthew Gardner, Chief Economist, Windermere Real Estate

It’s the time of the year when I look deep into my crystal ball to see what’s on the horizon for the upcoming year. As we are all aware, 2017 has been a stellar year for housing across the country, but can we expect that to continue in 2018?

Here are my thoughts:

Millennial Home Buyers

Last year, I predicted that the big story for 2017 would be millennial home buyers and it appears I was a little too bullish. To date, first-time buyers have made up 34% of all home purchases this year – still below the 40% that is expected in a normalized market. Although they are buying, it is not across all regions of the country, but rather in less expensive markets such as North Dakota, Ohio, and Maryland.

For the coming year, I believe the number of millennial buyers will expand further and be one of the biggest influencers in the U.S. housing market. I also believe that they will begin buying in more expensive markets. That’s because millennials are getting older and further into their careers, enabling them to save more money and raise their credit profiles.

Existing Home Sales

As far as existing home sales are concerned, in 2018 we should expect a reasonable increase of 3.7% – or 5.62 million housing units. In many areas, demand will continue to exceed supply, but a slight increase in inventory will help take some heat off the market. Because of this, home prices are likely to rise but by a more modest 4.4%.

New Home Sales

New home sales in 2018 should rise by around 8% to 655,000 units, with prices increasing by 4.1%. While housing starts – and therefore sales – will rise next year, they will still remain well below the long-term average due to escalating land, labor, materials, and regulatory costs. I do hold out hope that home builders will be able to help meet the high demand we’re expecting from first-time buyers, but in many markets it’s very difficult for them to do so due to rising construction costs.

Interest Rates

Interest rates continue to baffle forecasters. The anticipated rise that many of us have been predicting for several years has yet to materialize. As it stands right now, my forecast for 2018 is for interest rates to rise modestly to an average of 4.4% for a conventional 30-year fixed-rate mortgage – still remarkably low when compared to historic averages.

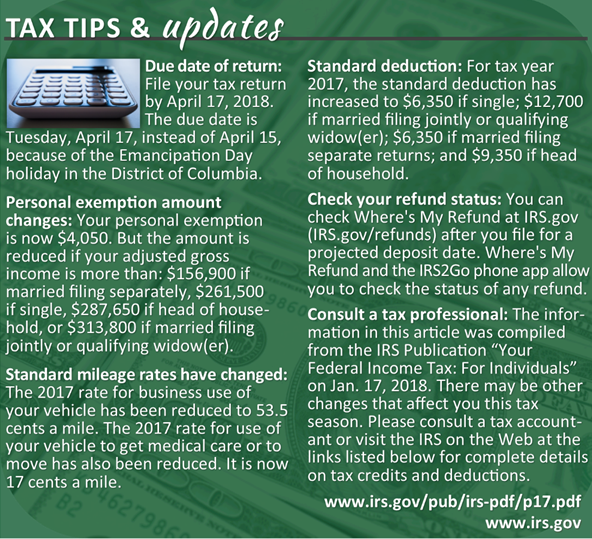

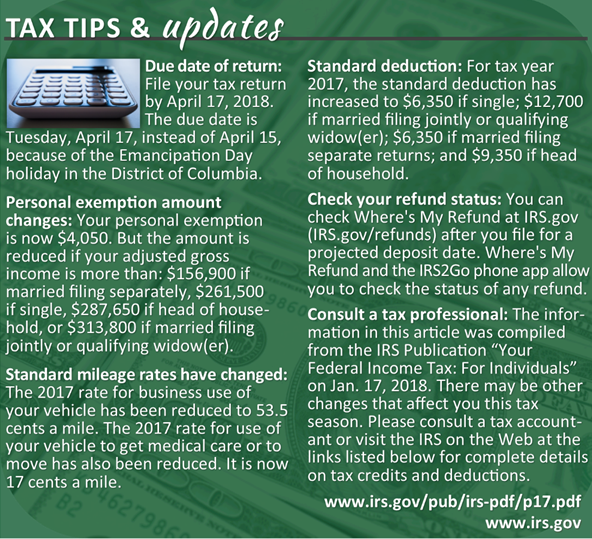

Tax Reform

Something that has the potential to have a major impact on housing are the current proposals relative to tax reform. As I write this, we know that both the House and Senate propose doubling the standard deduction, and the House plans to lower the mortgage interest deduction from $1,000,000 to $500,000. If passed, the mortgage deduction would no longer have value for home owners who would likely opt to take the standard deduction.

If either of the current proposals is adopted into law, the potential reduction in mortgage-related tax savings means the after-tax cost of home ownership will increase for most home owners. Additionally, both the House and Senate bills also end tax benefits for interest on second homes, and this could have a devastating effect in areas with higher concentrations of second homes.

The capping of the deduction for state and local property taxes (SALT) at $10,000 will also negatively impact states with high property taxes, such as California, Connecticut, and New York. Furthermore, proposed changes to the capital gains exemption on profits from the sale of a home (requiring five years of continuous residence as compared to the current two) could impact approximately 750,000 home sellers a year and slow the growth of home ownership.

Something else to consider is that all of the aforementioned changes will only affect new home purchases, which I fear might become a deterrent for current home owners to sell. Given the severe shortage of homes for sale in a number of markets across the country, this could serve to exacerbate an already-persistent problem.

Housing Bubble

I continue to be concerned about housing affordability. Home prices have been rising across much of the country at unsustainable rates, and although I still contend that we are not in “bubble” territory, it does represent a substantial impediment to the long-term health of the housing market. But if home price growth begins to taper, as I predict it will in 2018, that should provide some relief in many markets where there are concerns about a housing bubble.

In summary, along with slowing home price growth, there should be a modest improvement in the number of homes for sale in 2018, and the total home sales will be higher than 2017. First-time buyers will continue to play a substantial role in the nation’s housing market, but their influence may be limited depending on where the government lands on tax reform.

Windermere Foundation Quarterly Report | Q3 2017

|

|||

|

|||

|

|||

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

One organization that has been the recipient of Windermere Foundation funds is

One organization that has been the recipient of Windermere Foundation funds is